Making the switch to hybrid or electric

As demand for hybrid and electric vehicles increases, we have seen further measures such as clean air zones become implemented across the UK. Now may be the perfect time for your business to make the switch from conventionally-fuelled vehicles to hybrid or electric.

Planning and making the transition to a green fleet will be an individual challenge, requiring specific needs dependent on business operations. However, reviewing your fleet policy to adjust your vehicle choice is not as inconvenient as you may first expect.

Pendragon Vehicle Management can assist in evaluating your fleet’s fuel mix, recommending the ideal vehicle line-up to suit business needs, and remain compliant with the latest government guidelines.

Environmental Impact

With no tailpipe emissions, electric vehicles are friendlier to the environment and grant you free access to ULEZ zones.

Lower Running Costs

Charging is often cheaper than refuelling, resulting in electric cars being friendlier to your business' budget.

Cutting-Edge Technology

Electric vehicles come with the latest in technology, allowing your business to stay at the top of its game.

Corporate Responsibility

Improve your businesses reputation and meet corporate responsibility goals by choosing low emission vehicles.

Types of Hybrid and Electric Vehicles

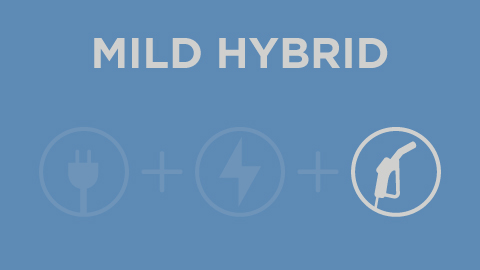

Mild Hybrid

Otherwise known as a MHEV, mild hybrids utilise a conventional engine that is supported by an electric motor to reduce emissions.

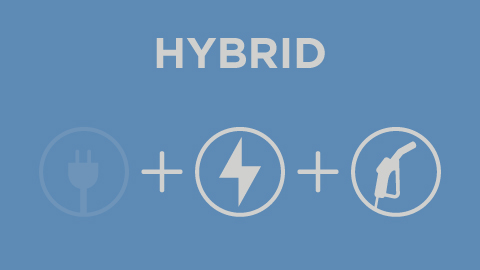

Hybrid

Otherwise known as HEV, hybrid vehicles have both a conventional engine and an electric motor, and can switch power input depending on road conditions.

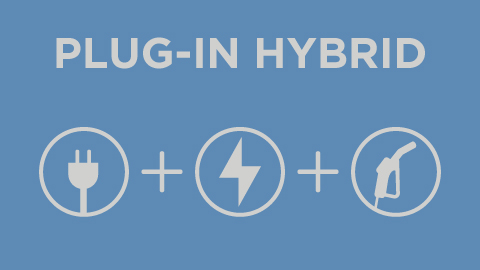

Plug-in Hybrid

Otherwise known as a PHEV, plug-in hybrids offer a conventional engine and larger electric power sources in order to travel further on in EV mode.

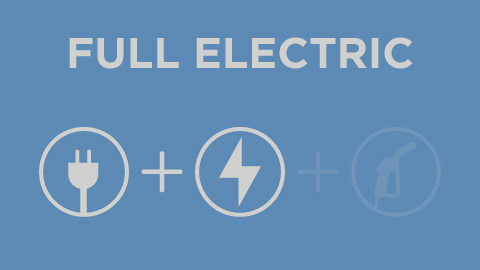

Full Electric

Otherwise known as an EV or BEV, full electric vehicles utilise electric power alone, allowing you to travel hundreds of miles with zero emissions.

Make your fleet hybrid or electric

Transitioning your fleet vehicles to hybrid and electric models is a forward-thinking and sustainable choice that brings numerous benefits. By embracing these eco-friendly alternatives, you can significantly reduce your carbon footprint, lower your running costs, and demonstrate your commitment to environment responsibility.

By prioritising the adoption of greener technologies like electric and hybrid vehicles, you can achieve a more sustainable future while simultaneously reaping the economic and environmental rewards of a cleaner fleet.